nj property tax relief check

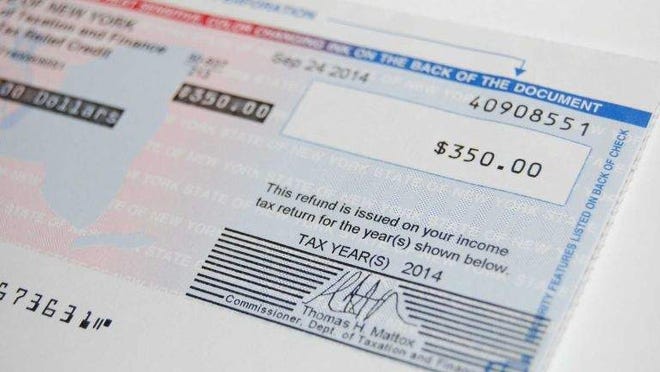

We have begun mailing 2021 Senior Freeze Property Tax. Web Residents who paid less than 500 in income tax will receive an amount equal to what they paid.

New York Property Owners Getting Rebate Checks Months Early

Roughly 870000 homeowners will qualify for a.

. Web About the Company Nj Property Tax Relief Fund Check 2021 CuraDebt is an organization that deals with debt relief in Hollywood Florida. For most homeowners the benefit is distributed to your municipality in the. We will begin paying ANCHOR benefits in the late Spring of 2023.

We have begun mailing 2021 Senior Freeze Property Tax. For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy. As an alternative taxpayers can file their returns online.

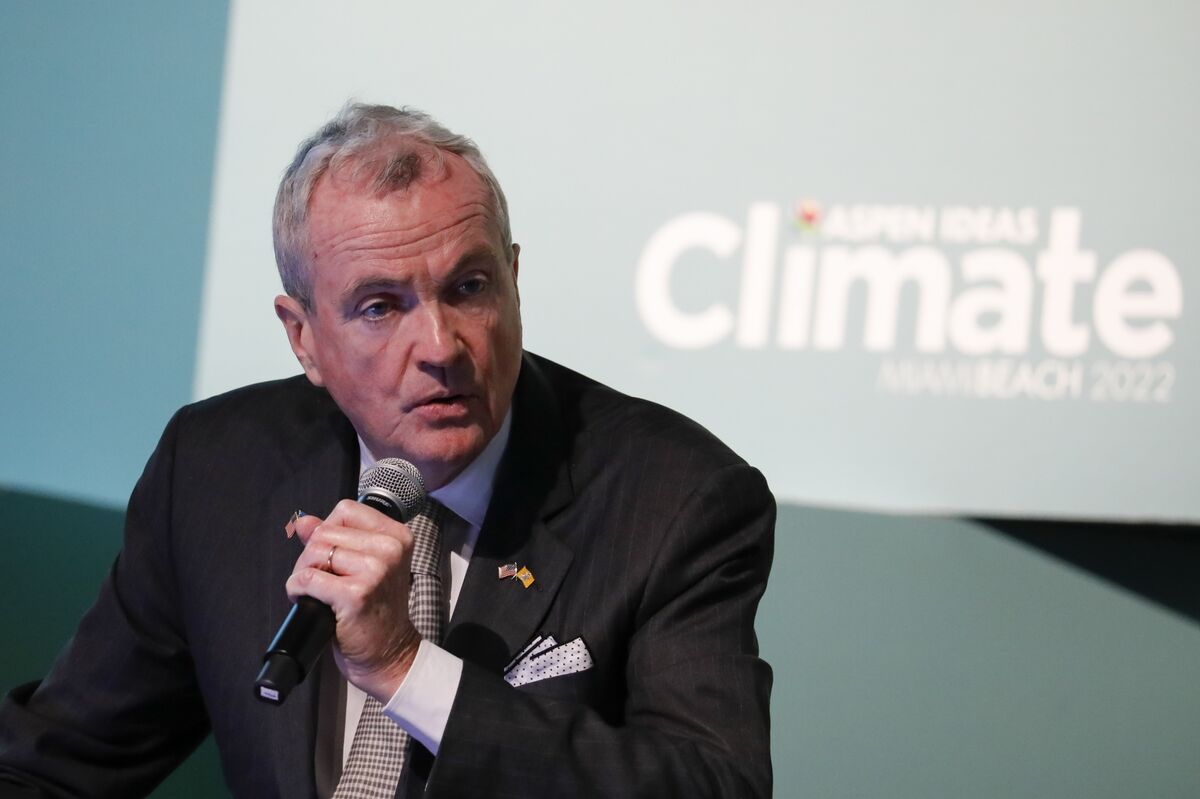

Web New Jersey Gov. Homeowners making up to 250000 per year. See How to File for more information.

Web Eligibility is based on New Jerseyans 2020 tax returns. Web Households with income below 150000 will receive a property tax credit for their 2023 property tax bill worth 1500. Web And the more than 900000 renters with incomes of up to 150000 will receive checks each year of 450 to help offset rent increases caused by increasing property taxes.

Ad No Money To Pay IRS Back Tax. With questions call New Jersey s Senior Freeze Property Tax Reimbursement Information. Web Under the new program known as ANCHOR homeowners making up to 150000 will receive 1500 rebates on their property tax bills and those making 150000 to.

Web The property tax rebates for homeowners would be boosted to 1500 and renters would get 450 checks to offset rent increases related to property taxes. Web The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. Web For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012.

Web The deadline for 2021 applications is October 31 2022. Web This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program. For example if an eligible family paid 250 in taxes they would get a 250.

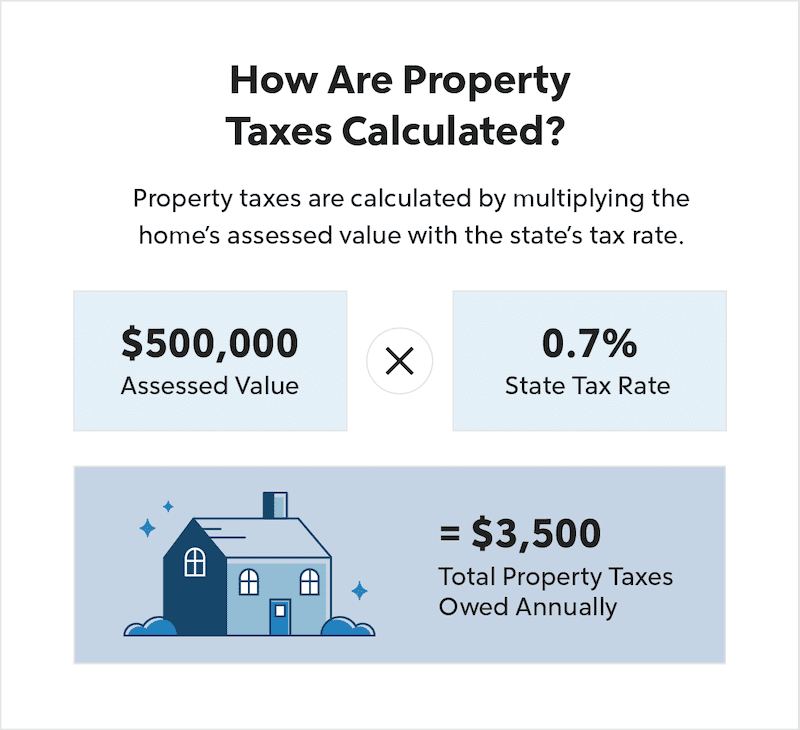

Web In 2021 the average New Jersey property tax bill was about 9300. For a middle-class family getting that 1500 in direct relief that average bill would become. Web The property tax relief programs are funded by state income tax payments.

See How to File for more information. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number.

Web Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. The first 51000 checks were scheduled to hit the mail Friday. Web The Homestead Benefit program provides property tax relief to eligible homeowners.

It was established in 2000 and is an. The state expects roughly 100000 checks to be. Web In 2021 the average New Jersey property tax bill was about 9300.

To put this in perspective. Web The deadline for filing your ANCHOR benefit application is December 30 2022. As an alternative taxpayers can file their returns online.

Web Division of Taxation. Web The deadline for 2021 applications is October 31 2022.

New York Property Owners Getting Rebate Checks Months Early

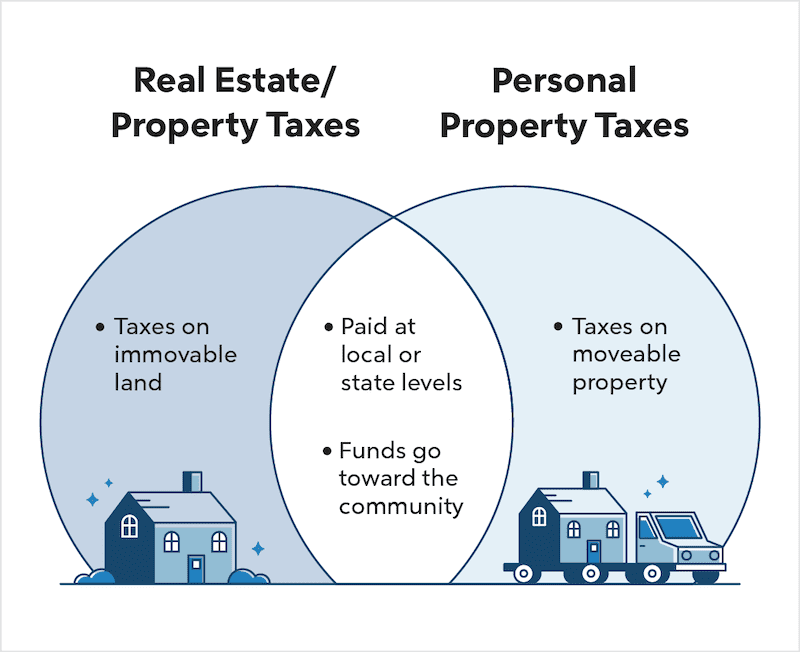

Real Estate Taxes Vs Property Taxes Quicken Loans

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

State Local Property Tax Collections Per Capita Tax Foundation

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York

Pin On Real Estate Investing Tips

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Real Estate Taxes Vs Property Taxes Quicken Loans

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Nj Property Tax Relief Program Updates Access Wealth

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Property Tax By State Ranking The Lowest To Highest

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

Property Taxes By State In 2022 A Complete Rundown